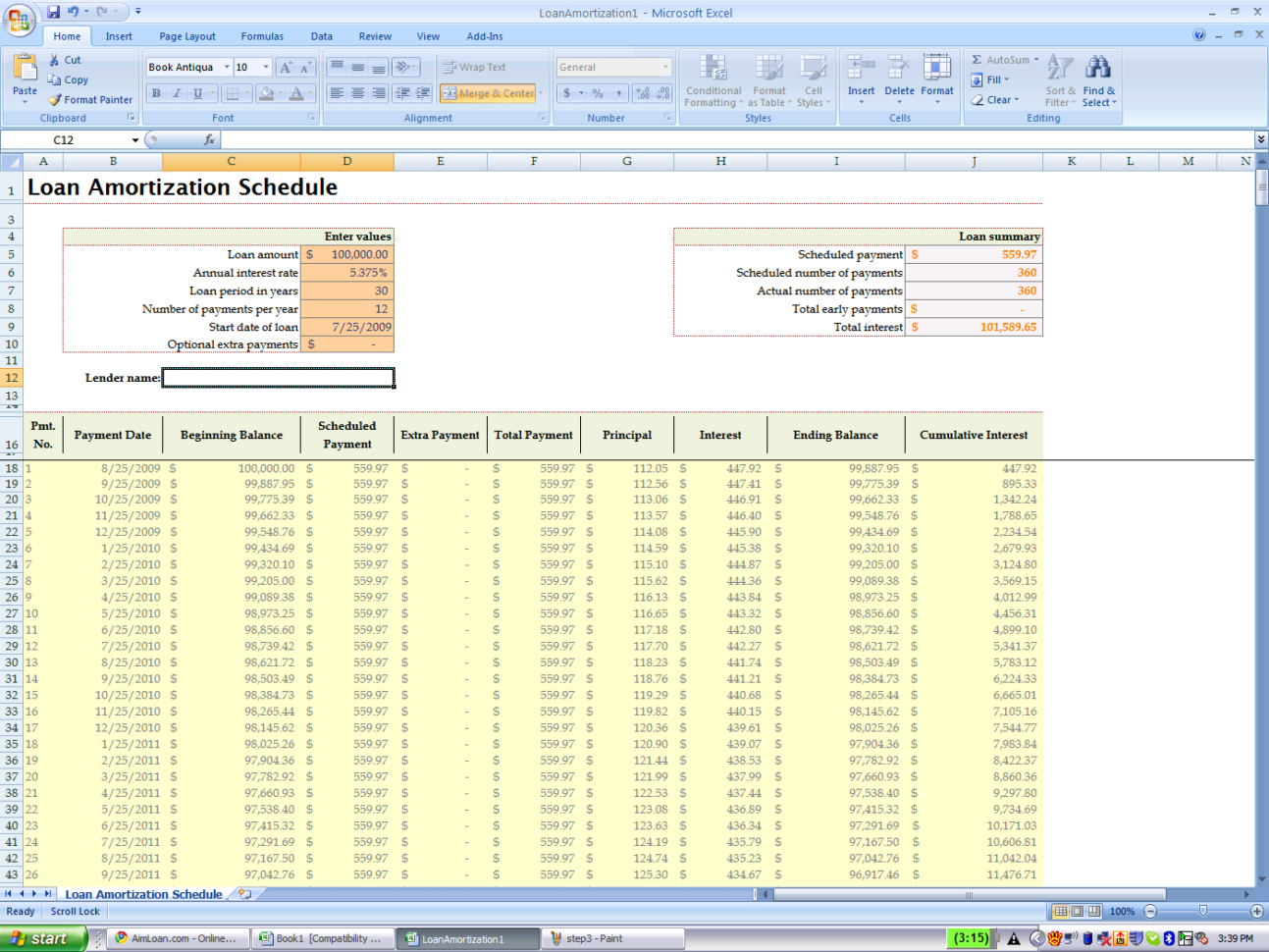

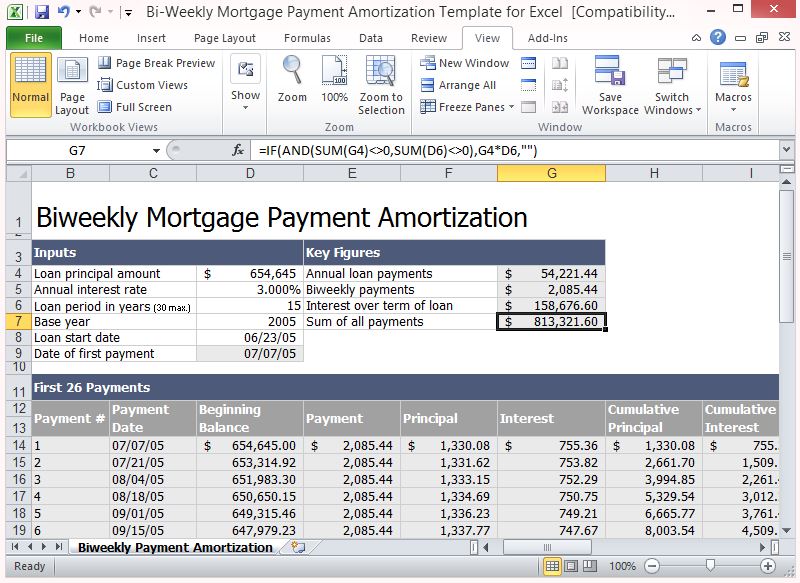

When most people buy homes using mortgage loans, they make monthly payments. The goal for anyone looking to make additional payments on their mortgage should be paying down as much of the principal as possible. If you apply additional payments to your principal to bring the amount down, the interest paid on the balance goes down as well because interest is calculated based on the principal balance.

This means that for the first few years of your loan, your payments are focused on paying off interest rather than principal. As this amount reduces, more and more of your payments will start applying to the principal - the actual amount you borrowed. In the beginning, the majority of your payments will be used to pay off the interest on your loan. The interest is what the lender charges for loaning you money to buy a house.ĭepending on the type of mortgage you have, your payments are usually consistent in amount and made monthly.

With each payment you make, you'll be paying off part of the principal amount and part of the interest. The amount you borrow is the loan principal. You make regular payments to repay this loan, usually monthly. When you take out a mortgage, you‘re borrowing money to buy or refinance a home.

#MORTGAGE CALCULATOR WITH EXTRA PAYMENTS BIWEEKLY HOW TO#

This article looks at how mortgage payments work, how to pay your mortgage and the pros and cons of monthly versus biweekly mortgage payments. Because it's such a big part of your and your family's life, it's important to know all the options available when it comes to paying back your mortgage. Buying home is an important milestone and likely the biggest purchase you'll ever make.

0 kommentar(er)

0 kommentar(er)